Introduction

In the dynamic and often volatile world of Forex and investment, success is frequently attributed to sharp analytical skills, robust strategies, and timely market insights. However, an equally, if not more, critical factor often overlooked is the psychological aspect of trading. The ability to manage one’s emotions, maintain discipline, and cultivate a resilient mindset can significantly differentiate between consistent profitability and repeated losses. This article delves into the intricate relationship between human psychology and trading performance, exploring common emotional pitfalls and offering practical strategies to master your emotions, ultimately paving the way for a more controlled and successful trading journey.

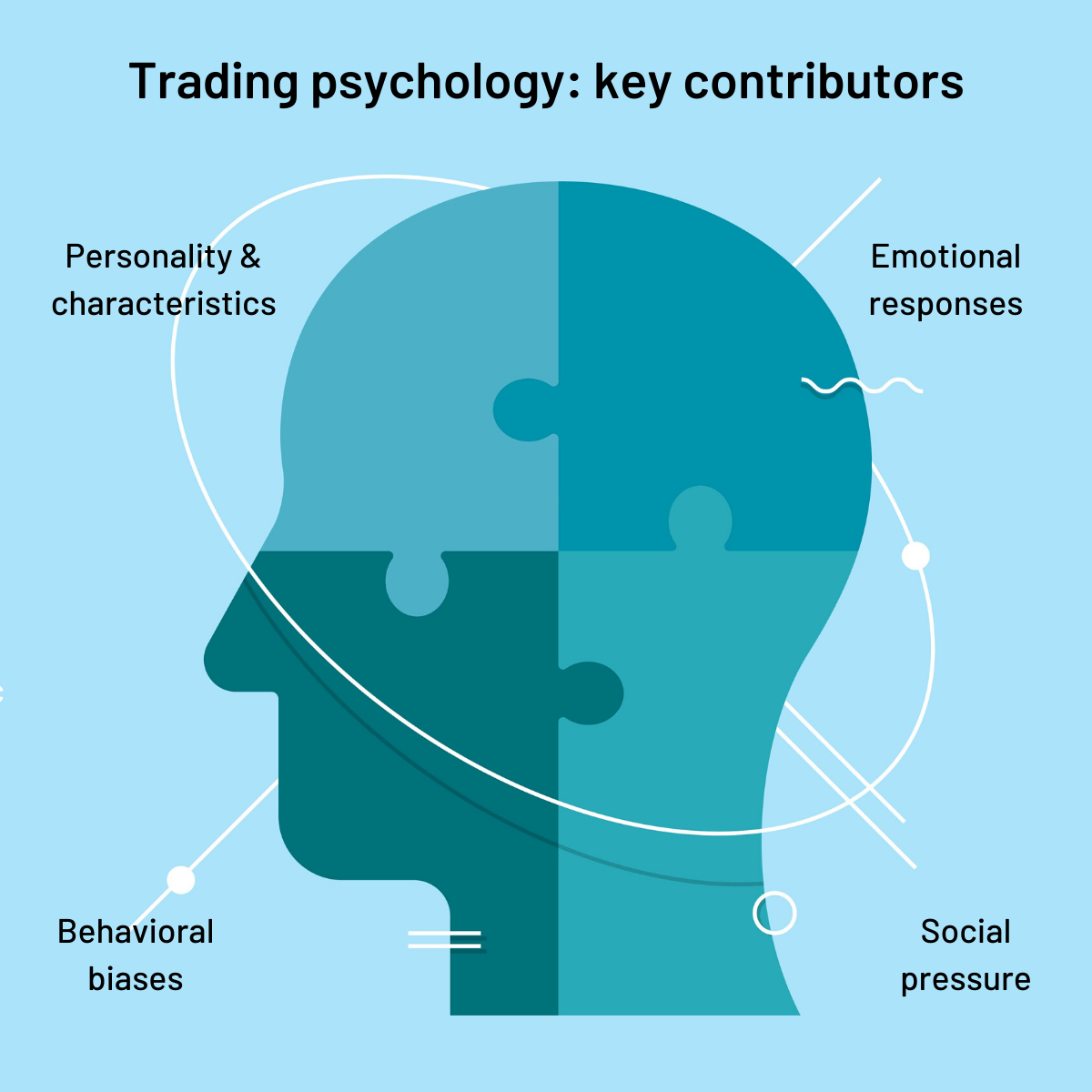

Understanding Trading Psychology

Trading psychology refers to the emotional and mental state of a trader, encompassing their attitudes, beliefs, and behaviors that influence their decision-making process in the financial markets. It’s a critical component of trading success, often cited as being more important than technical analysis or fundamental research alone. While market analysis provides the ‘what’ and ‘when’ to trade, psychology dictates the ‘how’ – how a trader reacts to market fluctuations, manages risk, and adheres to their trading plan.

The financial markets are inherently unpredictable, characterized by constant price movements driven by a multitude of factors, including economic data, geopolitical events, and investor sentiment. This environment can trigger a wide range of human emotions, such as fear, greed, hope, and regret. These emotions, if left unchecked, can lead to irrational decisions, deviating from a well-thought-out strategy, and ultimately, significant financial losses. Therefore, understanding and managing these psychological responses is paramount for any trader aiming for long-term success.

The interplay between emotions and decision-making in trading is complex. For instance, the thrill of a winning trade can lead to overconfidence, prompting a trader to take on excessive risk. Conversely, a series of losses can induce fear, causing a trader to hesitate or exit profitable positions prematurely. Recognizing these emotional triggers and their potential impact on trading behavior is the first step towards developing a robust trading psychology.

Common Emotional Biases in Trading

Even the most experienced traders can fall prey to various emotional and cognitive biases that distort judgment and lead to suboptimal trading decisions. Recognizing these biases is crucial for developing strategies to mitigate their impact.

- Loss Aversion: This bias describes the tendency to strongly prefer avoiding losses over acquiring equivalent gains. In trading, it can manifest as holding onto losing positions for too long, hoping for a turnaround, or cutting winning trades too short to lock in small profits, thereby missing out on larger gains. The pain of a loss often feels more intense than the pleasure of an equivalent gain [1].

- Overconfidence Bias: Traders exhibiting overconfidence may overestimate their abilities, the accuracy of their predictions, or the precision of their information. This can lead to excessive risk-taking, larger position sizes than warranted, or neglecting proper risk management protocols. Overconfidence often stems from a series of successful trades, leading to a false sense of invincibility [2].

- Sunk Cost Fallacy: This bias occurs when past investments (time, money, effort) influence future decisions, even if those past investments are irrecoverable. In trading, it means continuing to hold a losing position because of the capital already invested, rather than objectively assessing the current market conditions and cutting losses. The rational decision would be to ignore the sunk cost and focus on future potential [3].

- Confirmation Bias: Traders with confirmation bias tend to seek out, interpret, and remember information that confirms their existing beliefs or hypotheses, while ignoring evidence that contradicts them. This can lead to a skewed perception of the market, where a trader only sees what they want to see, reinforcing poor decisions and preventing objective analysis [4].

- Fear and Greed: These are perhaps the two most fundamental emotions in trading. Fear can cause panic selling, missing out on opportunities, or being too conservative. Greed can lead to chasing unsustainable gains, overtrading, or taking on excessive leverage. Both emotions can override rational thought and lead to impulsive, detrimental actions.

Strategies to Master Your Emotions

Mastering emotions in trading is not about eliminating them entirely, but rather about understanding, acknowledging, and managing them effectively. Here are several strategies to cultivate emotional discipline:

- Developing a Trading Plan and Sticking to It: A well-defined trading plan acts as a roadmap, outlining entry and exit points, risk management rules, and profit targets. Crucially, it should be developed when emotions are calm and rational. Adhering strictly to this plan removes the need for impulsive decisions driven by fear or greed during live trading. This discipline helps to automate decision-making and reduces the influence of emotional biases.

- Risk Management and Position Sizing: Proper risk management is the cornerstone of emotional control. By only risking a small percentage of your capital on any single trade (e.g., 1-2%), the potential loss becomes less emotionally impactful. Appropriate position sizing ensures that even if a trade goes against you, it doesn’t significantly jeopardize your overall capital, thus reducing fear and anxiety.

- Mindfulness and Self-Awareness: Practicing mindfulness can help traders become more aware of their emotional state in real-time. Recognizing when emotions like fear or excitement are rising allows a trader to pause, step back, and reassess the situation objectively before acting. Keeping a trading journal to record not just trades, but also the emotions felt before, during, and after, can provide valuable insights into personal emotional triggers.

- Emotional Detachment and Objectivity: Cultivating emotional detachment means viewing each trade as an independent event, rather than a reflection of personal worth or a continuation of past successes or failures. This objectivity allows for clearer analysis and decision-making, free from the baggage of previous outcomes. Focus on the process, not just the outcome.

- Learning from Mistakes (without emotional baggage): Losses are an inevitable part of trading. Instead of dwelling on them with regret or anger, successful traders view them as learning opportunities. Analyze what went wrong, identify areas for improvement in the strategy or execution, and move on without letting the emotional pain of the loss affect future decisions.

- Automating Trading Decisions (where appropriate): For some traders, especially those prone to emotional impulsivity, automating parts of their trading strategy can be highly beneficial. This can involve setting stop-loss and take-profit orders immediately after entering a trade, or even employing algorithmic trading systems that execute trades based on predefined rules, thereby removing human emotion from the execution process.

Building a Resilient Trader Mindset

Beyond specific strategies for managing emotions, cultivating a resilient trader mindset is crucial for long-term success. This involves developing certain psychological traits and approaches to the market:

- Discipline and Patience: These are twin pillars of a resilient mindset. Discipline involves consistently adhering to your trading plan, even when it’s difficult or when emotions are high. Patience means waiting for the right opportunities, not forcing trades, and allowing your strategy to play out over time. Impatience often leads to overtrading and poor decision-making.

- Realistic Expectations: The media often portrays trading as a get-rich-quick scheme, leading to unrealistic expectations. A resilient trader understands that consistent profitability comes from small, incremental gains over time, not from every trade being a massive winner. Accepting that losses are part of the game and focusing on overall portfolio growth helps to manage disappointment and maintain perspective.

- Continuous Learning and Adaptation: The financial markets are constantly evolving. A resilient trader is committed to continuous learning, adapting their strategies, and refining their understanding of market dynamics. This intellectual curiosity and flexibility prevent stagnation and help in navigating new challenges without being overwhelmed by uncertainty.

Conclusion

The journey to becoming a consistently profitable trader extends far beyond mastering technical analysis or understanding market fundamentals. It is, at its core, a profound exercise in self-mastery. The psychology of trading, encompassing the intricate dance between emotions and decision-making, plays an indispensable role in determining long-term success. By diligently recognizing and addressing common emotional biases such as loss aversion, overconfidence, and the seductive pull of fear and greed, traders can begin to build a more robust and rational approach to the markets.

Implementing strategies like strict adherence to a well-defined trading plan, rigorous risk management, and cultivating self-awareness through mindfulness are not merely suggestions but necessities for emotional mastery. Furthermore, fostering a resilient trader mindset characterized by discipline, patience, realistic expectations, and a commitment to continuous learning will equip traders to navigate the inevitable ups and downs of the financial markets with greater equanimity and effectiveness. Ultimately, mastering your emotions in trading is not about eradicating them, but about harnessing them, transforming potential liabilities into powerful assets on the path to sustained profitability.

References

- Investopedia: How Trading Psychology Affects Your Investment Success

- Britannica Money: Trading Psychology: How to Develop a Trader Mindset

- Charles Schwab: What is the Sunk Cost Fallacy and How Does It Work?