Introduction

In the dynamic world of Forex and investment, understanding market movements is paramount for success. Economic indicators serve as vital tools, offering insights into the health and direction of an economy. By analyzing these statistical data points, traders and investors can anticipate potential shifts in currency values, commodity prices, and stock markets, thereby making more informed decisions. This article delves into the various types of economic indicators, their significance, and practical strategies for leveraging them to predict market movements effectively.

Understanding Economic Indicators

What are Economic Indicators?

Economic indicators are macroeconomic statistics that provide insights into the current state and future direction of an economy. They are released by government agencies, research institutions, and private organizations, offering a snapshot of economic activity. These indicators can reflect various aspects of an economy, including production, employment, inflation, consumer spending, and international trade.

Types of Economic Indicators

Economic indicators are generally categorized into three types based on their relationship to economic cycles:

- Leading Indicators: These indicators signal future economic events and market changes before they occur. They are highly valued by investors as they provide early warnings of economic shifts, typically three to 12 months in advance. Examples include the stock market, building permits, manufacturing orders, and consumer confidence surveys.

- Coincident Indicators: These indicators measure current economic activity and change simultaneously with the economy. They confirm that economic shifts are indeed happening and provide real-time context. Examples include Gross Domestic Product (GDP), industrial production, personal income, and retail sales.

- Lagging Indicators: These indicators change after the economy has already begun to follow a particular trend or pattern. They are backward-looking and are useful for confirming long-term trends and validating what leading indicators previously suggested. Examples include the unemployment rate, corporate profits, and inflation.

Key Economic Indicators for Market Prediction

Several economic indicators are particularly influential in predicting market movements, especially in the Forex and investment sectors:

Gross Domestic Product (GDP)

GDP is the broadest measure of a nation’s economic activity, representing the total monetary value of all finished goods and services produced within a country’s borders in a specific time period. A robust GDP growth often indicates a healthy economy, which can lead to a stronger national currency and attract foreign investment.

Consumer Price Index (CPI) / Inflation

The Consumer Price Index (CPI) measures the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. It is a key indicator of inflation. Rising CPI can suggest potential currency depreciation due to eroding purchasing power, while controlled inflation can be favorable for a currency.

Unemployment Rate / Non-Farm Payroll (NFP)

The unemployment rate measures the percentage of the total labor force that is unemployed but actively seeking employment. The Non-Farm Payroll (NFP) report, released monthly in the U.S., measures the number of employed people in the U.S. excluding farm employees and some government workers. Lower unemployment rates and strong NFP figures generally indicate economic strength, leading to potential currency appreciation.

Interest Rates / Central Bank Policies

Interest rates, set by central banks, are powerful tools for managing economic stability. A rise in interest rates can attract foreign investment seeking higher returns, thereby strengthening the national currency. Conversely, rate cuts can weaken it. Central bank announcements and policy changes are closely watched by traders for their significant impact on currency markets.

Purchasing Managers’ Index (PMI)

The Purchasing Managers’ Index (PMI) is an indicator of the economic health of the manufacturing and service sectors. A PMI reading above 50 indicates expansion, while a reading below 50 indicates contraction. Rising PMI levels signal economic expansion, which is a positive sign for the national currency and overall market sentiment.

Retail Sales

Retail sales data provides insights into consumer spending patterns, which account for a significant portion of economic activity. Robust retail sales indicate strong consumer confidence and economic growth, often leading to an uptrend in the national currency.

Trade Balance

The trade balance measures the difference between a country’s exports and imports. A trade surplus (exports exceed imports) can lead to currency appreciation as foreign demand for the country’s goods and services increases, requiring more of its currency. A trade deficit (imports exceed exports) can have the opposite effect.

Consumer Confidence Index

The Consumer Confidence Index reflects the optimism or pessimism of consumers regarding the state of the economy. Higher consumer confidence often translates into increased spending, boosting economic activity and strengthening the currency.

Yield Curve

The yield curve illustrates the relationship between interest rates and bond maturities. Normally, longer-term bonds offer higher interest rates, resulting in an upward-sloping curve. An inverted yield curve, where short-term rates exceed long-term rates, has historically been a reliable predictor of an upcoming recession.

How to Use Economic Indicators in Forex and Investment

Effectively utilizing economic indicators requires a strategic approach:

Holistic Analysis

No single economic indicator provides a complete picture. Traders should consider a combination of indicators to gain a comprehensive understanding of economic health. Analyzing leading, coincident, and lagging indicators together offers a more balanced perspective and helps in cross-validation.

Economic Calendar

Staying informed about upcoming releases of economic data is crucial. An economic calendar provides schedules for these releases, allowing traders to anticipate market volatility and prepare their strategies accordingly. Timely reactions to significant data releases can be critical for capitalizing on market movements.

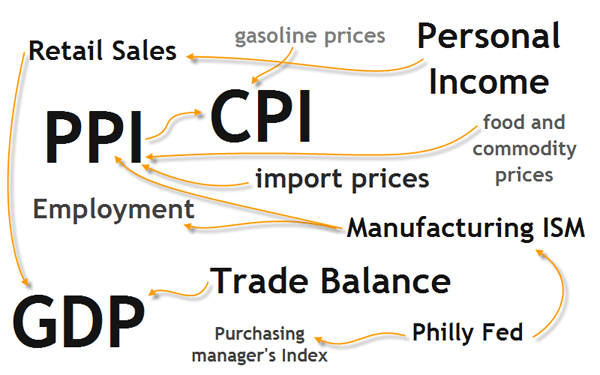

Interconnectedness

Economic indicators are interconnected, and changes in one can trigger chain reactions across others and the broader market. Understanding these relationships, such as how inflation might influence interest rate decisions, is vital for accurate market prediction.

Risk Management

While economic indicators offer valuable insights, the Forex and investment markets inherently carry risks. Traders should integrate economic indicator analysis into a robust risk management strategy. This includes setting stop-loss orders, managing position sizes, and avoiding over-leveraging, especially during periods of high volatility around major economic announcements.

Adaptability

Market dynamics are constantly evolving, and economic indicators can sometimes be influenced by unexpected events. Traders must remain adaptable, ready to adjust their trading strategies based on new economic data and market reactions. Continuous learning and staying updated with global economic trends are essential for long-term success.

Conclusion

Economic indicators are indispensable tools for anyone looking to navigate the complexities of the Forex and investment markets. By providing a window into economic health and future trends, they empower traders and investors to make more informed decisions. However, it is crucial to remember that these indicators are not infallible. A balanced approach that combines thorough analysis of multiple indicators, adherence to an economic calendar, understanding of their interconnectedness, robust risk management, and continuous adaptability is key to effectively using economic indicators to predict market movements and achieve trading goals.

References

- Investopedia. (n.d.). Economic Indicators That Help Predict Market Trends. Retrieved from https://www.investopedia.com/articles/economics/08/leading-economic-indicators.asp

- FXView. (n.d.). 9 Popular Economic Indicators in Forex. Retrieved from https://fxview.com/global/blogs/9-popular-economic-indicators-in-forex

- Forex.com. (n.d.). What are Economic Indicators and Why are They Important? Retrieved from https://www.forex.com/en-us/trading-guides/what-are-economic-indicators/