Introduction

In the dynamic world of investment, focusing solely on one asset class, such as Forex, can expose investors to significant risks. While foreign exchange markets offer unique opportunities, a truly resilient and growth-oriented investment strategy necessitates a broader perspective. This article delves into the critical importance of building a **diversified investment portfolio beyond Forex**, exploring various asset classes, strategic allocation methods, and essential maintenance practices to help investors achieve long-term financial goals with reduced risk.

Diversification is a fundamental principle in investment, often encapsulated by the adage, “Don’t put all your eggs in one basket.” [1] This strategy involves spreading investments across different asset classes, sectors, and geographical regions to mitigate the impact of adverse movements in any single investment. By understanding and implementing effective diversification techniques, investors can create a more stable portfolio, potentially enhancing returns while safeguarding against significant losses.

Why Diversify Beyond Forex?

The Forex market, characterized by its high liquidity and 24/5 operation, presents both lucrative opportunities and substantial risks. Its volatility, influenced by geopolitical events, economic data releases, and central bank policies, can lead to rapid and unpredictable price swings. While some investors thrive on this volatility, an exclusive focus on Forex can leave a portfolio vulnerable to significant drawdowns during unfavorable market conditions.

Over-reliance on any single asset class, including Forex, means that the entire portfolio’s performance is tied to the fortunes of that one market. If that market experiences a downturn, the entire investment can suffer. A diversified approach, however, ensures that if one segment of the portfolio underperforms, other segments may compensate, thereby stabilizing overall returns and reducing the impact of market-specific risks. [1] [2]

Furthermore, different asset classes react differently to economic cycles and market events. For instance, during periods of economic uncertainty, equities might decline, while certain bonds or alternative assets might perform relatively well. By incorporating a variety of assets, investors can create a portfolio that is more resilient to various market environments, offering a smoother return profile over the long term. [3]

Understanding Diversification

Diversification is not merely about holding a variety of investments; it’s about strategically combining assets that react differently to market forces. The core concept behind diversification is **correlation**, which measures how different investments move in relation to one another. A well-diversified portfolio aims for low correlation among its assets, meaning that when one investment performs poorly, another might perform well, offsetting potential losses. [1]

For example, historically, when stock prices fall, bond prices tend to rise, or at least remain more stable. By holding both stocks and bonds, an investor can mitigate the impact of significant swings in either market. [1] This principle extends to various types of investments, including different industries, company sizes, geographic regions, and investment styles.

The benefits of diversification are primarily focused on **risk management** rather than maximizing returns. While it doesn’t guarantee profits or protect against all losses, it significantly reduces the overall risk and volatility of a portfolio. This approach allows investors to participate in the broader market without being overly exposed to the idiosyncratic risks of a single asset or sector. [1]

Key Asset Classes for Diversification

To effectively diversify a portfolio beyond Forex, investors should consider a range of asset classes, each with its own risk and return characteristics. These include traditional assets like stocks and bonds, as well as alternative investments.

Stocks (Equities)

Stocks represent ownership in a company and offer the potential for capital appreciation and dividends. They are generally considered higher-risk, higher-reward investments compared to bonds. To diversify within equities, investors should consider:

- Market Capitalization: Investing in a mix of large-cap, mid-cap, and small-cap companies. Different-sized companies can perform differently across various economic cycles. [1]

- Sectors: Spreading investments across diverse industries such as technology, healthcare, energy, and financials. This prevents over-reliance on any single industry, which can be susceptible to specific market trends or disruptions. [1]

- Geographic Regions: Including both domestic and international markets, including developed and emerging economies. This reduces country-specific risks and allows participation in global growth opportunities. [1] [3]

- Investment Styles: Balancing between growth stocks (companies expected to grow faster than the overall market) and value stocks (companies trading below their intrinsic value). [2]

Bonds (Fixed Income)

Bonds are debt instruments issued by governments, municipalities, or corporations. They are generally considered less volatile than stocks and provide a steady stream of income through interest payments. Bonds play a crucial role in diversification by offering stability and reducing overall portfolio risk, especially during equity market downturns. [1] Key considerations for bond diversification include:

- Varying Maturities: Investing in bonds with different maturity dates (short-term, intermediate-term, and long-term) to manage interest rate risk.

- Credit Qualities: Including a mix of government bonds (typically lower risk) and corporate bonds (higher risk but potentially higher yield).

- Types of Bonds: Considering Treasury bonds, municipal bonds, and corporate bonds to spread risk across different issuers. [1]

Alternative Investments

Alternative investments are assets that fall outside traditional categories like stocks, bonds, and cash. They can offer unique diversification benefits due to their low correlation with conventional assets, potentially enhancing returns and further reducing portfolio volatility. [3] Examples include:

- Real Estate: Direct property ownership or investments in Real Estate Investment Trusts (REITs) can provide income and capital appreciation, often acting as a hedge against inflation. [1]

- Commodities: Raw materials like gold, silver, oil, and agricultural products. Gold, in particular, is often considered a safe-haven asset during economic uncertainty and inflationary periods. [3]

- Private Equity/Debt: Investments in non-public companies or private debt, which can offer higher returns but come with lower liquidity and higher risk.

- Hedge Funds and Managed Futures: These strategies often employ complex techniques to generate returns and can have low correlation with traditional markets. [3]

Building a Diversified Portfolio

Constructing a diversified portfolio is a deliberate process that begins with understanding one’s financial objectives, risk tolerance, and investment horizon. The goal is to create an asset mix that aligns with these personal factors, rather than simply accumulating various assets. [2]

Asset Allocation Strategies

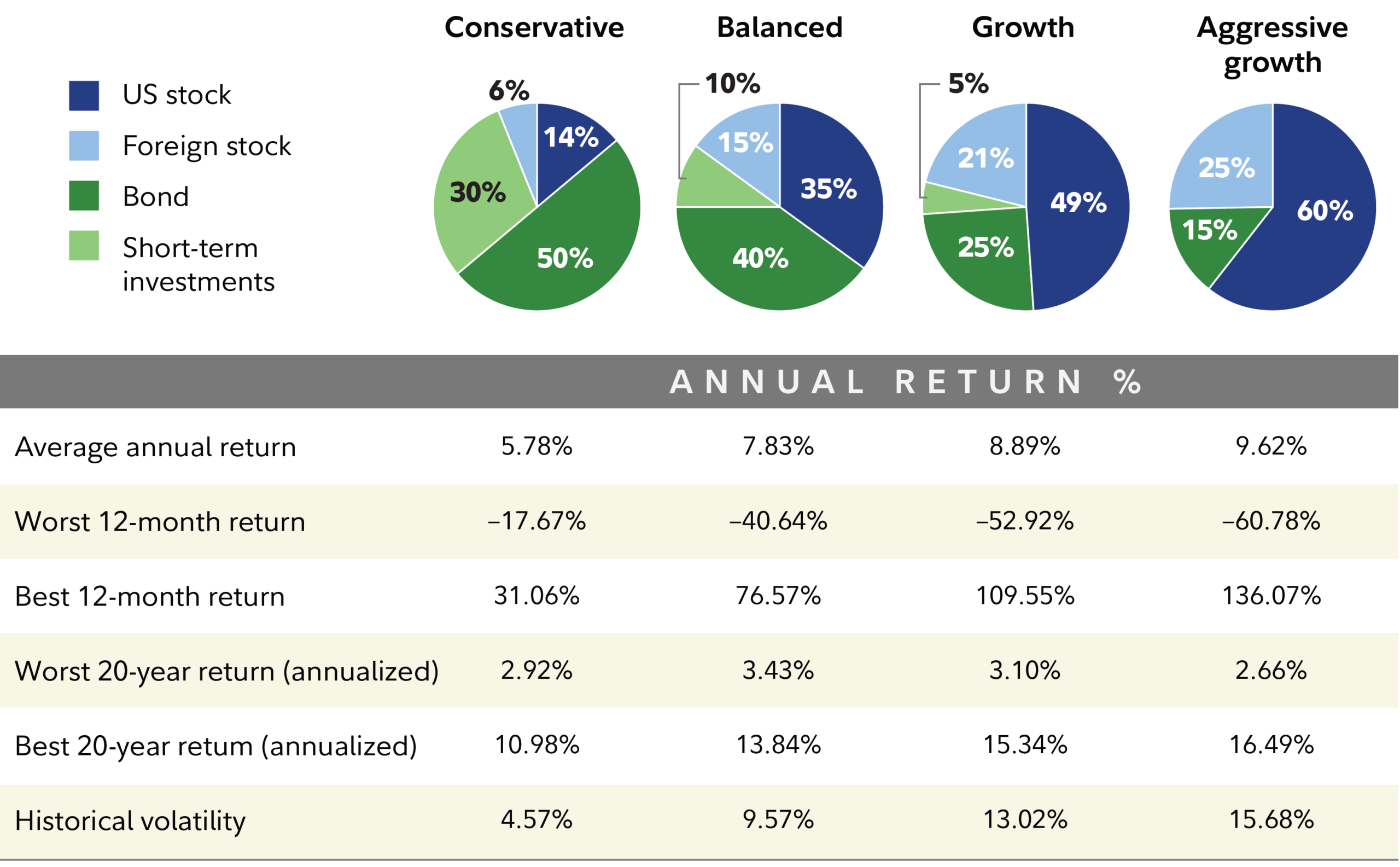

Asset allocation is the process of dividing an investment portfolio among different asset categories, such as stocks, bonds, and cash. The proportion allocated to each asset class is crucial and depends heavily on an individual’s risk profile and time frame. Common allocation strategies include: [1] [2]

- Aggressive: Typically, a higher percentage in stocks (e.g., 80% stocks/20% bonds) for investors with a long time horizon and a high tolerance for risk, seeking maximum growth.

- Moderate: A balanced approach (e.g., 60% stocks/40% bonds) suitable for investors with a moderate risk tolerance and a medium-term horizon, aiming for a balance between growth and stability.

- Conservative: A larger allocation to bonds (e.g., 40% stocks/60% bonds) for investors with a shorter time horizon or lower risk tolerance, prioritizing capital preservation and income.

A higher allocation to stocks generally offers greater growth potential but also comes with increased volatility, while a higher bond allocation provides more stability but may temper long-term returns. [1]

Diversifying Within Asset Classes

Beyond allocating across major asset classes, true diversification involves spreading investments within each category. For stocks, this means considering market capitalization, sectors, geographic regions, and investment styles. For bonds, it involves varying maturities, credit qualities, and types of bonds. This multi-faceted approach ensures that the portfolio is not overly reliant on any single factor for performance. [1] [2]

The Role of Mutual Funds and ETFs

For many investors, achieving broad diversification across numerous individual securities can be challenging and time-consuming. Mutual funds and Exchange-Traded Funds (ETFs) offer an efficient solution. These professionally managed funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. They provide instant diversification, often at a lower cost than buying individual securities, and can be tailored to various investment objectives and risk profiles. [1]

Automation in Portfolio Management

Digital platforms and robo-advisors have made building and managing diversified portfolios more accessible. These platforms can automatically construct and rebalance a portfolio based on an investor’s goals and risk profile, leveraging algorithms to maintain the desired asset allocation. This automation can help investors stay disciplined and avoid emotional decision-making, which is crucial for long-term success. [1]

Maintaining a Diversified Portfolio

Building a diversified portfolio is not a one-time event; it requires ongoing maintenance and adjustment. Market movements can cause the initial asset allocation to drift over time, potentially exposing the portfolio to unintended risks or altering its risk-return profile. Therefore, regular monitoring and rebalancing are essential to ensure the portfolio remains aligned with the investor’s goals and risk tolerance. [1] [2]

The Importance of Rebalancing

Rebalancing is the process of adjusting a portfolio back to its original target asset allocation. For example, if stocks have performed exceptionally well, their proportion in the portfolio might exceed the target allocation. Rebalancing would involve selling some of the outperforming stocks and investing the proceeds into underperforming assets, such as bonds, to restore the desired balance. This practice helps to:

- Control Risk: Prevents the portfolio from becoming overly concentrated in assets that have experienced significant gains, which could increase overall risk.

- Buy Low, Sell High: Encourages a disciplined approach of selling assets that have risen in value and buying those that have fallen, aligning with the fundamental investment principle. [1]

- Maintain Alignment: Ensures the portfolio continues to reflect the investor’s risk tolerance and long-term financial objectives. [2]

Financial advisors often recommend reviewing portfolios annually and rebalancing when an asset class deviates by more than 5%–10% from its target allocation. [1]

Regular Review and Adjustment

Beyond periodic rebalancing, it is crucial to conduct a comprehensive review of the overall asset mix. An investor’s financial circumstances, goals, and risk tolerance can change over time due to life events such as career changes, family additions, or approaching retirement. These changes necessitate a re-evaluation of the portfolio’s structure to ensure it remains appropriate. For instance, as retirement approaches, an investor might choose to reduce the portfolio’s risk profile by allocating more to bonds and cash. [1] [2]

Common Diversification Mistakes to Avoid

While diversification is a powerful tool, investors can inadvertently undermine its effectiveness through common pitfalls:

- Excessive Diversification (Diworsification): Some investors, in an attempt to diversify, invest in too many funds or securities with overlapping holdings. This can lead to unnecessarily increased investment costs and dilute the impact of well-performing assets without significantly reducing risk. [1]

- Ignoring Correlation: True diversification involves combining assets that do not move in lockstep. Investing in multiple assets that are highly correlated (e.g., several different types of precious metals) may not provide the desired risk reduction, as they tend to perform similarly under the same market conditions. [1]

- Forgetting to Rebalance: As discussed, market movements can cause a portfolio to drift from its target allocation. Failing to rebalance means the portfolio’s risk profile can change without the investor’s intent, potentially leading to overexposure to volatile assets or under-exposure to stable ones. [1] [2]

- Chasing Performance: Making investment decisions based on past performance rather than long-term strategy can lead to buying high and selling low. A diversified portfolio is built on a strategic allocation designed for long-term goals, not short-term market trends. [2]

- Lack of Global Diversification: Concentrating investments solely in domestic markets can expose a portfolio to country-specific economic or political risks. Global diversification, including emerging markets, can offer additional risk reduction and growth opportunities. [3]

Conclusion

Building a diversified investment portfolio beyond Forex is not merely a recommendation but a fundamental necessity for long-term financial success and risk management. While Forex markets offer compelling opportunities, a singular focus can expose investors to undue volatility and concentrated risks. By strategically allocating investments across a broad spectrum of asset classes—including stocks, bonds, and various alternative investments—investors can construct a portfolio that is resilient to market fluctuations and aligned with their individual financial objectives. [1] [2]

Effective diversification extends beyond simply holding multiple assets; it demands a thoughtful approach to asset allocation, careful consideration of correlations between investments, and diligent maintenance through regular rebalancing and periodic reviews. Avoiding common pitfalls such as excessive diversification or neglecting to rebalance ensures that the portfolio remains robust and continues to serve its intended purpose. [1] [2] [3]

Ultimately, a well-diversified portfolio acts as a powerful shield against unforeseen market events, allowing investors to navigate the complexities of the financial landscape with greater confidence. By embracing a comprehensive and disciplined diversification strategy, individuals can enhance their potential for consistent returns, mitigate risks, and steadily progress towards their long-term wealth accumulation goals.

References

- Vanguard. Portfolio diversification: What it is and how it works.

- Fidelity. Guide to diversification.

- Goldman Sachs. How to Build a Global Investment Portfolio for the Next Decade.